Demographic Pressures and Economic Dynamics in Sindh Housing Market

The housing dynamics in Sindh presents a complex interplay of demographic pressures and economic constraints, as revealed by the 2023 Census data. With a population of 55.7 million growing at 2.57% annually, and urban areas expanding even faster at 3.24%, the province faces unprecedented housing challenges. The urban areas, home to 53.97% of the population, demonstrate a significant disparity in living conditions compared to rural regions. This demographic pressure is further intensified by household compositions, where urban families in the lowest income quintile support an average of 8.27 members with just 2.22 employed individuals, while their rural counterparts maintain 7.70 members with 2.50 employed persons. The economic disparity becomes even more evident in household incomes, with urban areas averaging PKR 107,596 monthly compared to rural areas’ PKR 56,881, yet this urban premium comes with significantly higher living costs and housing expenses.

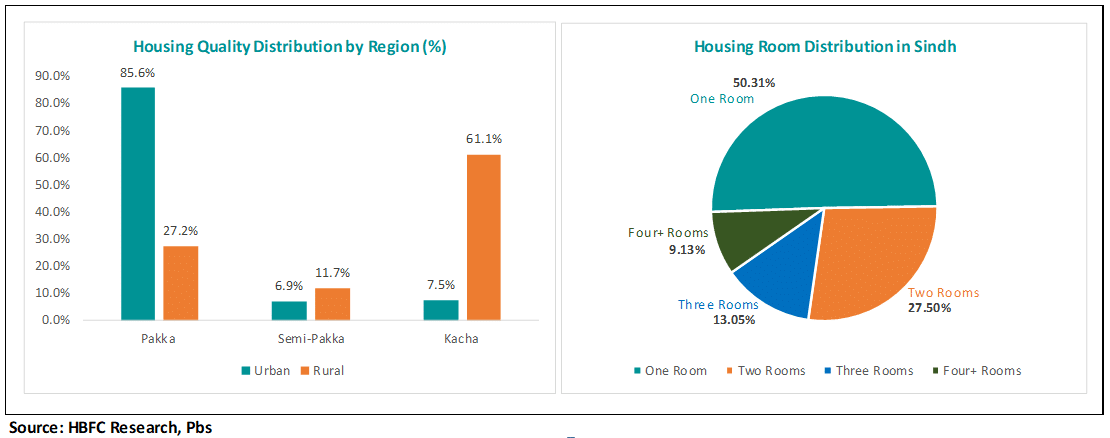

Housing Stock Distribution and Living Patterns a Regional Assessment of Sindh

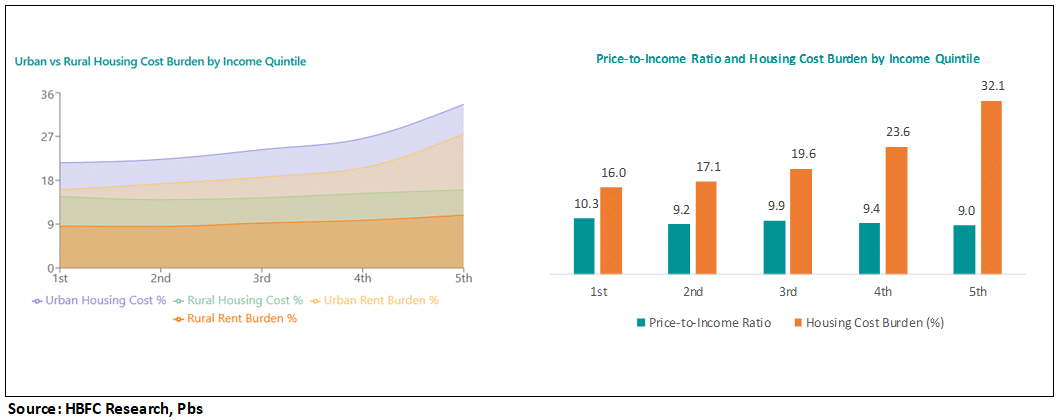

The current housing stock of 9.86 million units reveals deep-rooted inequalities in housing quality and accessibility across Sindh. In urban areas, 85.6% of houses are Pakka (permanent structures), while rural areas see only 27.2% of such housing, with 61% being Kacha (temporary) dwellings. This quality disparity is accompanied by concerning ownership patterns, where 76.1% of houses are owner-occupied, but only 4.5% are owned by women. The housing crisis is further exemplified by space constraints, with 50.3% of all households confined to single-room dwellings. The financial burden of housing is particularly severe in urban areas, where households spend 30.1% of their income on housing compared to 14.8% in rural areas, and renters face an even steeper burden of 24.15% of income going to rent in urban areas versus 9.20% in rural regions. These statistics indicate a severe affordability crisis, especially considering that the lower two income quintiles consistently show negative monthly savings (-PKR 1,725 for the first quintile and -PKR 190 for the second quintile).

Housing Market Metrics Analyzing Affordability Indicators in Sindh

The affordability metrics paint an alarming picture of housing accessibility in Sindh. With a median house price of PKR 4.34 million and current interest rates at 17.5%, the typical monthly mortgage payment of PKR 44,540 represents 52.86% of monthly income for the median household. The Housing Affordability Index (HAI) of 0.6 indicates that the median household income falls 40% short of the PKR 1.78 million annual income required to qualify for a mortgage, with actual median annual income at just PKR 1.01 million. This creates an insurmountable gap of PKR 770,493 in annual income needed for formal housing finance. The severity of the situation is further highlighted by price-to-income ratios ranging from 10.28 for the first quintile to 9.00 for the fifth quintile, all significantly exceeding the internationally recommended ratio of 3-4. These findings underscore the urgent need for comprehensive policy interventions addressing both supply and demand-side constraints in Sindh’s housing market, particularly focusing on innovative financing solutions for lower-income quintiles and measures to improve housing quality in rural areas.

Housing Policy Framework Current Initiatives and Development Pathways

In response to these pressing challenges, the Sindh government’s announcement of the Sasti Basti Initiative in September 2024 marks a significant step toward addressing housing affordability. This initiative, coupled with recent policy measures such as the Sindh High Density Development Board’s efforts to increase vertical housing development and the Katchi Abadi regularization program, demonstrates a multi-faceted approach to the housing crisis. However, the success of these programs will depend heavily on their implementation and alignment with market realities. Given the current HAI of 0.6 and the significant income gap for mortgage qualification, future policy interventions should focus on innovative financing mechanisms, including graduated payment mortgages, shared equity schemes, and rent-to-own programs. Additionally, the government should consider establishing a dedicated housing microfinance facility targeting households in the lower income quintiles, potentially incorporating Islamic financing principles to increase accessibility. The integration of green building standards and sustainable development practices into these initiatives could also help reduce long-term housing costs while promoting environmental sustainability. Furthermore, specific attention must be paid to addressing the gender disparity in housing ownership, perhaps through targeted programs offering preferential terms for women homeowners and female-headed households. These comprehensive policy measures, combined with continued monitoring of affordability metrics and housing quality indicators, will be crucial in creating a more inclusive and sustainable housing market in Sindh.