Monthly Payments Matter More Than Interest Rates for Housing Affordability

When most people think about housing affordability, their minds often go straight to interest rates the cost of borrowing. While interest rates undeniably affect the total amount repaid on a mortgage, they are not the core issue when determining whether a home is affordable. In fact, the ability to make manageable monthly payments is the critical factor, even if the loan were entirely interest-free. This perspective shifts the focus from rates to real-world capacity how much a household can pay each month without sinking into financial distress.

Defining Affordable Housing

Affordable housing is housing that doesn’t put undue financial strain on a household. It means that a person or family should not have to allocate more than a reasonable portion of their income typically 30-40% to housing costs, including rent or mortgage payments. Anything

beyond that threshold can leave households struggling to cover other essential expenses, such as food, healthcare, and education.

Housing Affordability in Pakistan: A Matter of Monthly Payments

Take Pakistan as a case study. The average house price has continued to rise, while the monthly income of households remains relatively low. The interest rate in Pakistan has averaged 12% over the past two decades, making mortgage payments even more expensive. But the real issue isn’t the interest rate it’s the Equated Monthly Installment (EMI) that outstrip what the average household can afford. Consider this example: For a median house price of Rs. 3,000,000, with a loan amount of Rs. 2,100,000 (after a 30% deposit), a monthly income of Rs. 63,504, a loan term of 20 years (240 months), and an interest rate of 1.5% per month, the Equated Monthly Installment (EMI) comes to Rs. 31,603, or about 50% of monthly income. Even without any interest, a monthly payment of this magnitude is unaffordable for most households.

The Real Cost of Waiting: Why Monthly Mortgage Capacity Matters

Too many loan seekers make the mistake of focusing on interest rates, thinking that a lower rate will make homeownership more affordable. While interest rates do affect the overall cost of a loan, what truly matters is how much you can comfortably pay each month. Your monthly mortgage capacity should be the focus when determining whether you can afford a home, not just the interest rate.

For example, you might be offered a loan today that fits your budget in terms of monthly payments, even with a high interest rate. If you wait for interest rates to fall but don’t secure a property, house prices may increase, leaving you with a higher overall payment in the future even at a lower interest rate. This means you’ll need a larger loan in the future, making it even more challenging to stay within your monthly installment capacity.

Why Waiting Can Be Risky

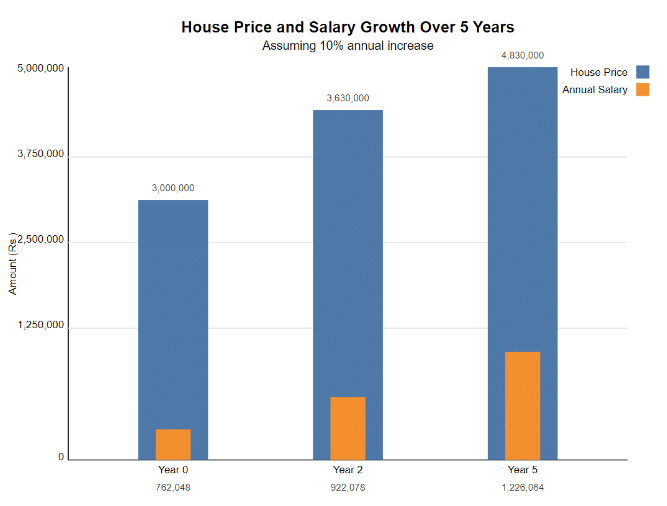

Consider a scenario where inflation causes both house prices and salaries to increase by 10% annually. Even with matching growth rates, in 5 years, the median house price would rise by about 61%, significantly outpacing absolute salary increases in monetary terms. This means you’d need a much larger loan to buy the same house, and your ability to save for a down payment might not keep pace with rising prices. Consequently, your buying power could effectively decrease over time, even if interest rates drop, making it harder to afford the same home in the future.

The Catch

Even though both house prices and salaries grow at 10%, the absolute numbers matter. The house price grows by Rs. 1.8 million in 5 years, but your salary only increases by about Rs. 38,000 per month. While this seems proportional, the down payment requirement and the overall loan amount you’d need are much higher.

Current median house price: Rs. 3,000,000

- 30% down payment: Rs. 900,000

- Loan amount: Rs. 2,100,000

- Equated Monthly Installment (EMI) (20 years at 12% interest): Rs. 23,119

Future median house price: (after 5 years): Rs. 4,860,000

- 30% down payment: Rs. 1,458,000

- Loan amount: Rs. 3,381,700

- Equated Monthly Installment (EMI) (20 years at 12% interest): Rs. 37,191

While your salary will increase, the down payment you’ll need in 5 years will grow by Rs. 558,000, and your Equated Monthly Installment (EMI) will increase by over Rs. 14,000 per month. Even with a 10% salary growth, the higher house price and the inflationary pressure on daily expenses will make it harder to meet the increased loan requirements and monthly payments.

Low Interest Rates and Innovative Schemes: Not a Cure-All for Global Housing Affordability

Globally, we see that housing affordability is more about how much households can afford to pay each month than about how much interest is charged on loans. The focus on monthly payments, rather than just interest rates, is evident in housing markets worldwide. Several developed nations, including Denmark, Switzerland, Sweden, Germany, the Netherlands, Belgium, and Finland, offer mortgage rates below 2% annually, with some even approaching 0%. Japan goes further, providing interest-free or very low-interest housing loans. Despite these favorable terms, these countries continue to face significant housing affordability challenges, particularly

in major urban centers like Tokyo. This phenomenon underscores a crucial point: even in advanced economies with stable financial systems, low interest rates alone do not solve housing affordability problems. The high Equated Monthly Installments (EMI) required to buy property in these cities often remain beyond what many households can afford, regardless of interest rates.

To address these challenges, some countries have implemented innovative solutions. For instance, South Africa has introduced a creative Rent-to-Own scheme with capped mortgage payments, ensuring that housing costs remain manageable by limiting them to 30-35% of a household’s income, regardless of interest rates. This approach, focusing on monthly payment capacity rather than interest rates, offers a potential model for other nations. For developing countries like Pakistan, these global insights suggest that a more holistic approach to housing affordability is needed, one that considers factors such as income levels, housing supply, and broader economic conditions, rather than focusing solely on interest rates.

Why Interest Rates Play a Smaller Role in Affordability

The examples of Japan and South Africa reveal an essential truth: housing affordability depends more on house prices and income levels than on interest rates. In both high- and low-interest rate environments, what truly determines whether a family can afford a home is how much they have to pay every month.

Consider Pakistan again. Suppose the government offers an interest-free housing loan for a Rs. 3,000,000 home. Even in this scenario, a monthly payment of over Rs. 25,000 (assuming a 20-year loan term) would still be unaffordable for most households, whose incomes may be Rs. 50,000 or less. This means that interest-free loans alone do not guarantee affordability unless house prices are also reasonable relative to income.

Global Analysis: House Price-to-per Capita Income Ratio

The House Price-to-per Capita Income Ratio reveals diverse housing affordability across Asian cities, with Pakistan’s Karachi showing a ratio of 4.82, positioning it in the middle range of the analyzed cities. This ratio suggests that Karachi maintains moderate affordability despite having one of the lowest per capita incomes ($1,494) among the countries analyzed. Karachi’s position is more favorable than some of its neighbors like Mumbai (6.88) and Dhaka (4.90), indicating relatively proportional housing prices to incomes. However, Pakistan’s low absolute per capita income means housing costs remain challenging for many residents, especially when compared to cities like Hong Kong (0.05) or Shanghai (0.08) where the ratios are surprisingly low, or Singapore’s Marina Bay (7.50) where high incomes are offset by even higher housing prices. This global perspective underscores that while Pakistan faces significant affordability challenges due to low incomes, its housing market maintains a balance that is comparatively better than some higher-income cities, suggesting that focused policies on increasing incomes and managing housing costs could significantly improve affordability.

Addressing the Real Issue: Income and House Prices

To achieve true housing affordability, policymakers must focus on balancing house prices with monthly income. Interest rates can fluctuate, but if monthly payments are out of reach, housing will remain unaffordable. Solutions like capped mortgages (as in South Africa) or interest-free loans (as in Japan) help, but they don’t solve the underlying issue unless house prices are brought in line with income levels.

In Pakistan, addressing the affordability crisis will require more than just tinkering with interest rates. What’s needed is a comprehensive approach that includes:

- Reducing house prices through subsidized housing programs.

- Increasing household incomes through economic growth.

- Implementing payment caps to ensure that no family spends more than 30-35% of their

income on housing.

Conclusion: Affordability Hinges on Monthly Payments

In conclusion, housing affordability is primarily about how much a family can pay each month, not about the interest rate. Even in markets with interest-free loans, high house prices can make housing unaffordable. Countries like Japan and South Africa demonstrate that the key to affordability lies in ensuring manageable Equated Monthly Installment (EMI). For Pakistan and other developing countries, the solution to the housing crisis must focus on making both house prices and monthly payments realistic and affordable for average households.