Demographic Pressures and Housing Demand

Khyber Pakhtunkhwa presents a unique demographic landscape with a population of 40.86 million and a density of 401.57 persons per square kilometer. The province’s distinctive feature is its predominantly rural character, with only 15.01% urban population – significantly lower than other provinces. Growing at an annual rate of 2.38%, with rural areas showing a notably higher growth rate of 2.69% compared to urban areas at 0.72%, Khyber Pakhtunkhwa faces unique housing challenges. The average household size of 6.9 members (6.7 in urban and 6.9 in rural areas) is among the highest in Pakistan, creating substantial pressure on housing needs.

Employment Patterns and Household Economics

The employment dynamics in Khyber Pakhtunkhwa reveal distinctive patterns across income quintiles. Urban households in the lowest quintile support an average of approx 10 members with just 2 employed individuals, while rural counterparts maintain approx 9 members with approx 1 employed persons. The economic landscape shows urban households averaging PKR 113,549 monthly versus rural areas’ PKR 85,474. Despite lower average incomes, Khyber Pakhtunkhwa demonstrates positive savings across all quintiles, ranging from PKR 4,446 in the first quintile to PKR 16,083 in the fifth quintile, showcasing strong financial management practices among households.

Housing Quality and Distribution

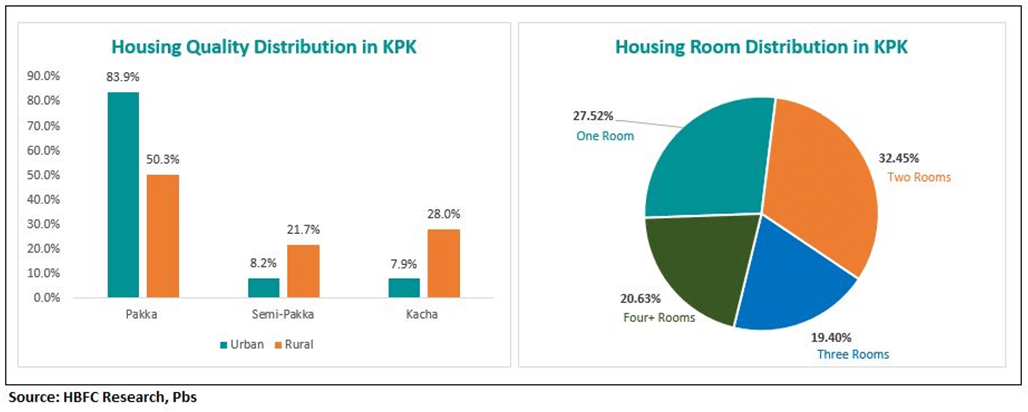

The housing stock of 5.86 million units reflects significant quality variations across Khyber Pakhtunkhwa. Urban areas show better housing quality with 83.9% Pakka structures, while rural areas maintain 50.4% Pakka houses. The presence of 1.46 million Kacha houses (24.8% of total stock) indicates substantial need for housing quality improvement. Ownership patterns reveal that 84% of houses are owner-occupied, though female ownership remains low at 3.4%. Room distribution analysis shows 27.5% single-room dwellings, 32.5% two-room houses, 19.4% three-room accommodations, and 20.6% enjoying four or more rooms, highlighting varying levels of spatial adequacy across households.

Affordability Metrics and Financial Burden

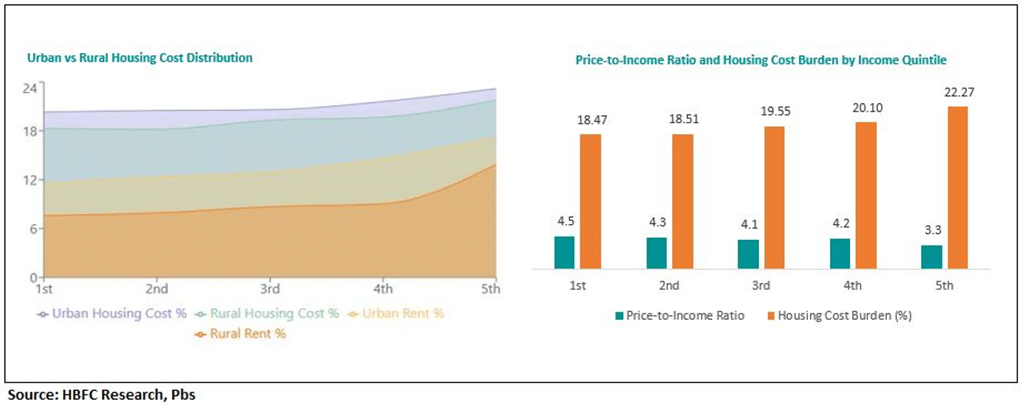

Housing affordability in Khyber Pakhtunkhwa shows distinctive patterns across regions and income groups. Urban households face a housing cost burden of 22% compared to 19.7% in rural areas. The rent burden is particularly noticeable in urban areas (15.12%) versus rural regions (9.80%). With a median house price of PKR 3.29 million (first quintile) and current prevailing interest rate, the typical monthly mortgage payment of PKR 33,802 represents 37.49% of monthly income for the median household. The Housing Affordability Index (HAI) of 0.8 indicates that median household income falls 20% short of the PKR 1.35 million annual income required for mortgage qualification, with actual median annual income at PKR 1.08 million.

Policy Implications and Recommendations

In response to these housing challenges, the Khyber Pakhtunkhwa government has initiated significant steps through the EhsaasApnaGhar Program and inaugurated low-cost housing schemes under the Naya Pakistan Housing Programme (NPHP). These initiatives focus on providing affordable housing solutions, particularly targeting the lower-income segments. Given the current HAI of 0.8 and varying housing cost burdens across urban (22%) and rural (19.7%) areas, future policy interventions should focus on innovative financing mechanisms, including graduated payment mortgages, shared equity schemes, and rent-to-own programs. Additionally, the government should consider establishing dedicated housing microfinance facilities targeting households in the lower income quintiles, potentially incorporating Islamic financing principles to increase accessibility. The integration of green building standards into these initiatives could help reduce long-term housing costs while promoting environmental sustainability. Special attention must be paid to addressing the gender disparity in housing ownership, with only 3.4% female ownership, through targeted programs offering preferential terms for women homeowners. These comprehensive policy measures will be crucial in creating a more inclusive and sustainable housing market in Khyber Pakhtunkhwa.